Works no matter where you live. Moneyspire supports all regions and world currencies, and makes it easy for you to manage your money no matter where you are. Easily move from Quicken®, Mint® & more. Moneyspire lets you easily move from your existing personal finance software with its extensive importing options. The apps sync with the desktop version of Banktivity and there’s even an iWatch app with spending alerts to help keep you on budget. Investment management isn’t Banktivity’s strong point but there is a separate free Banktivity Investor app (formerly iBank Investor) which syncs investment data specifically. Banktivity is not available for Android but there are plenty of alternatives with similar functionality. The most popular Android alternative is GnuCash, which is both free and Open Source.

Banktivity

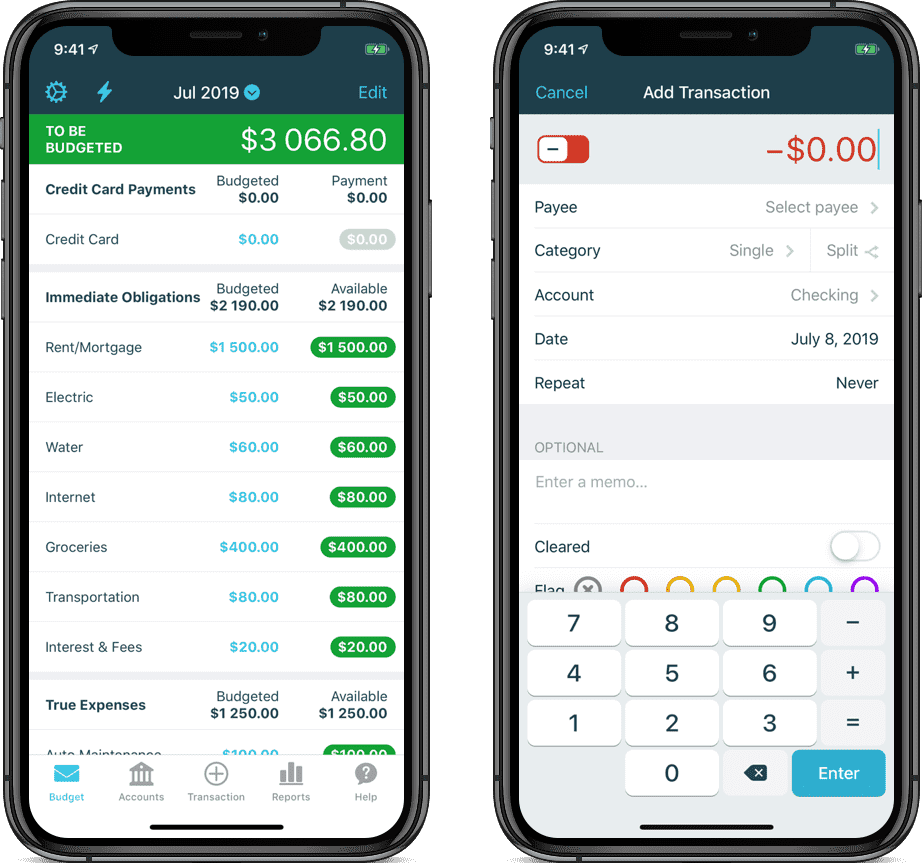

Banktivity is a full-featured personal accounting system for the Mac OS X operating systems. Either it is about making the budgets or keeping the record of online bill payment, Banktivity will deliver you the best accounting solution that will assist you in organizing your financial life in a more systemized and organized way.

Use the Banktivity and take control of your finances and plan for the future more reliably and genuinely. Banktivity is integrated with those features and financial management tools that will do everything well for you. Banktivity is a way to know where you stand and see what your current financial situation is.

The best about Banktivity is that in addition to working as a personal financial management tool, it also assists in the tracking of investment and making of investment plans as well. All the tools that are said to be the must-have elements for easy management of finances are part of the Banktivity.

The main highlighted features and advantages of using Banktivity are easily setup and installation, make reliable and achievable budgets, connect your bank accounts to manage the bank accounts, see where the money goes, cloud sync system, etc.

#1 Mint

Mint is a web-based money management application. Check out what Mint can do; credit card records, bill due and payment records, bank register, bill management, budgeting & investment, credit score, etc. No downloading, no installing, use in the air.

Today in the world of technology, earning more is no more complicated, but managing the earning is the real one. Mint is that accounting software that lets its users manage all their financial matters at one centralized place of the Mint.

It is about your expenses or budgets or about saving goals. Mint is such a type of money management application that lets you maintain every financial transaction and meet your saving goals by breaking the habits of wasting money. So, use Mint and do some justice with your income. Mint is a simple, secure, and effortless way of controlling your financials and making the dream a reality.

#2 Acorns

Acorns – Invest Spare Change has made it simple to invest the spare in your future. It is one of the best and easy to use app that helps you to spend and save in the background of life. The application has a community of more than three million people who can do it intuitively.

Acorns offer a painless investment of your spare change into a diversified portfolio of the ETFs of up to 7000 stocks and bunds automatically. With the help of this app, you can easily invest over time in recurring investments daily, weekly or monthly, and a one-time investment if you have extra cash.

The best part about Acorns is that it allows you to withdraw your amount anytime without any charges. Acorns include prominent features such as to invest as little as $5, easily spend over time, easy to use, the maximum time over time, watch the progress, high security, and more.

#3 Stash

Stash – Invest Learn Save is a Finance mobile application by Stash Invest for Android and iOS devices. Like all the other similar investing platforms, it also offers slight shares that let you invest how you want, no matter the share price. That means you only need $5 to start to invest in well-known stock and exchange-traded funds and themes that can help you create a balanced portfolio based on your beliefs.

It’s Auto- Stash feature lets you automate investing and saving so you can easily create wealth in the long run. It is a powerful application that offers coach features to help you navigate the world of investing through personalized challenges.

A complete variety of challenges to earn points, learn, and become the wealthier investor. Stash offers blog service where new articles and tips publish every to help you develop smarter financial habits and become a confident investor.

As compared to all the other similar applications, it offers lots of new tools and services to deliver and complete experience without any limitations. It introduces personal investment accounts, individual retirement account with all the tax benefits, and custodial investing accounts for children under 18. Stash also offers physical, electronic, and procedural safeguards to deliver a complete security system.

#4 Qapital

Qapital is an easy to use Finance application that allows you to save money automatically and take control of your spending. It is a powerful application that offers three different options to save your money, such as Save Money on Autopilot, Spend and Get a master Checking account, and Invest let your money for you. Each one has its features and methods.

The application is specially made for those people who have extra money and want to save or invest in any business. It manages all the tasks and offers a reliable platform to manage your finance needs.

Its spending mode offers a free checking account with a Qapital visa Debit Card. This will help you stick your budget and take control of your spending by keeping you informed. It has a list of core features that make it better than others.

#5 Money View

Money View is a leading platform that offers all-in-one finance solutions such as track spends automatically, view bank account, set budgets, bill reminder, and much more. It is the best solution that empowers people to be more aware of their finances and to do better with their money pro-actively.

The most addictive thing about this platform is that it allows you to get a load of more than 2, 00, 000 in just a few hours to solve your financial problems. As compared to all the other similar platforms, it is entirely secure and does not gain access to your personal information, bank OTP, password, and account number.

Money View is available to use on Android and web platforms, and you can access it anytime around India. The platform includes core features such as simple and easy to use, manage expenses, notifications, generate reports, set budgets, and much more.

#6 Stash Free

Stash Free is a personal finance and investing application that helps you to save and invest. The app is developed and published by Stash Invest, and you can download it on Android and iOS devices.

The application is specially designed for those who want to invest their amount in business and earn some commission. Unlike most of the other applications, Stash Free lets you buy fractional shares of stocks and funds, so you can quickly start investing with just $5. Through this app, you can explore a massive list of investments and build your portfolio while you learn to be a confident investor.

One of the best things about this platform is that it offers unlimited trading, education, and opportunity, and much more that makes it a comprehensive solution. The app also provides personal investment accounts, custodial accounts, and retirement account to invest for children under 18.

Each account has its benefits and lets you buy stocks, bonds, and funds with no add-on trading commissions. All Stash account comes with access to its new and education platform.

Read helpful guides and articles about investing, budgeting, and saving. Stay up-to-date on financial news and take quizzes to test your knowledge etc. There is also a massive range of unique features that make it more engaging.

#7 Cleo

Banktivity App For Android Free

Cleo is a platform that enables the users to track their spending, provides them a budget to save money, and offers a clear path to pursue their goals. The platform allows the users to know how to spend their money and on what they should spend it. Cleo provides a whole plan to its users to save their money to fulfill their dreams.

The application helps the users in saving money by evaluating what they can afford and what not through its AI technology. It allows the users to set goals, and with this platform, they can make it happen. Moreover, users can earn one percent of interest on their savings.

Cleo offers games and quizzes to allow the users to provide them financial awareness, and they can earn money through it. Lastly, the best thing about Cleo is, it automatically puts some money aside for the user every week.

1. Banktivity gives you a holistic view of your finances — checking accounts, savings, credit cards, real estate, mortgages, investments and budgets.

2. And you can sync accounts, budgets and investments to Banktivity for iPhone/iPad for mobile money management.

3. Banktivity's set-up assistant will import your old data and download current transactions from your bank accounts online.

4. Banktivity's Direct Access service makes this even easier by connecting to over 14,000 banks worldwide, automatically delivering the latest transaction data to your Mac.

Features and Description

Key Features

Latest Version: 8.4

Rated 2.7/5 By 81 People

What does Banktivity do? Make the Most of Your Money with BanktivityThe key to reaching all your financial goals comes down to one simple idea: Proactive Money Management. Banktivity gives you everything you need to do just that and more! And all in a user-friendly environment that’s safe and secure. You’ll have immediate access to the tools, resources and U.S.-based support to make smarter financial decisions.BANKTIVITY BRINGS IT ALL TOGETHERThe first step in better money management is getting all your finances and accounts into one place. Banktivity's Direct Access service makes this even easier by connecting to over 14,000 banks worldwide, automatically delivering the latest transaction data to your Mac.Banktivity's set-up assistant will import your old data and download current transactions from your bank accounts online.BANKTIVITY GIVES YOU THE BIG PICTURE Banktivity gives you a holistic view of your finances — checking accounts, savings, credit cards, real estate, mortgages, investments and budgets. You’ll easily track, categorize, tag, reconcile and manage every transaction. (Including online bill pay!) Do it all yourself or let Banktivity’s transaction templates do the work for you. It’s simple to update your accounts all at once with Banktivity's 'Update Everything' button. Sync devices, fetch Direct Access data, security prices even currency exchange rates. BUILD SAVINGS WITH BANKTIVITY BUDGETINGBanktivity's budgeting tools help you to set saving and proactive spending goals. By giving yourself available cash for specific purposes, Envelope Budgeting lets you assign money to different categories. And any money not spent can be carried carry over into your savings. Banktivity automatically budgets scheduled transactions like paychecks and bills (categorized to your Envelope Budget). You’ll always know how well you’re tracking to your budget and savings with Banktivity’s visually-driven Budget vs. Actual reports.BANKTIVITY SIMPLIFIES INVESTINGBanktivity's investment features manage stocks, bonds, mutual funds, IRAs, 401Ks, CDs and other assets. You can track buys, sells, splits, dividends, options and more. Banktivity calculates IRR, ROI and gains and losses. You can even pick which lots you've sold from.Built-in report templates (Income & Expense, Net Worth, Payee Summary and more) dynamically analyze your finances. Assign tax codes to transactions to generate Tax reports (or export to TurboTax). Or view holdings in the Portfolio or Investment Summary reports —presented in comprehensive graphics that let you drill down for details, export or print.BANKTIVITY’S WITH YOU ON THE GONo matter where you are, you can enter transactions on the go with Banktivity for iPhone. And you can sync accounts, budgets and investments to Banktivity for iPhone/iPad for mobile money management.Should you need help or have questions, we provide unlimited email support or Live Chat for quick solutions. Plus, Banktivity offers built-in Help files, a searchable Knowledge Base and video tutorials.It's time to take action and start PROACTIVELY managing your money. Download Banktivity now!

Download for MacOS - server 1 --> FreeDownload Latest Version

Download and Install Banktivity

Download for PC - server 1 -->Banktivity App For Android Download

MAC:

Banktivity App For Android Phone Number

Download for MacOS - server 1 --> FreeThank you for visiting our site. Have a nice day!